यह भी देखें

29.01.2026 10:02 AM

29.01.2026 10:02 AMThe good news for the S&P 500 is that corporate earnings may grow by double digits for a third consecutive year. The bad news is that everyone already knows that. At the end of 2025, not a single Wall Street analyst expected the broad index to fall in the new year. Investor surveys were unambiguously bullish. For now, the equity market is meeting expectations, but is this not simply buying the rumor? How far down can selling on the news take it?

2026 can safely be called a year of upheavals. Episodes involving Venezuela, Iran, Greenland, White House threats of new tariffs on Europe, South Korea, and Canada could have driven anyone out of US stocks. For the most part, though, investors treat negative factors as just noise. The US economy remains strong, which implies solid corporate reports and a buy case for the S&P 500.

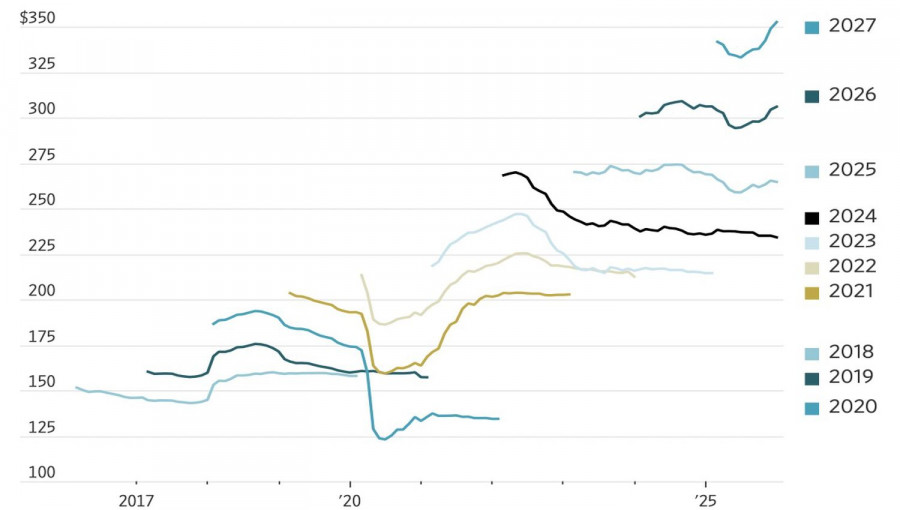

Dynamics of earnings estimates for S&P 500 companies

The Wall Street consensus forecast implies corporate earnings growth of 15% in 2026 and another 15% in 2027. Given the 13% gain in the metric in 2025, a series of double?digit increases looks impressive — the longest stretch since the 2008 global financial crisis. However, if something goes wrong, disappointment will follow. At the same time, mixed results from members of the Magnificent Seven in the fourth quarter highlight material risks. Disappointing numbers from Microsoft sent the stock down 5%, while Meta Platforms delivered a pleasant surprise and jumped by 10%.

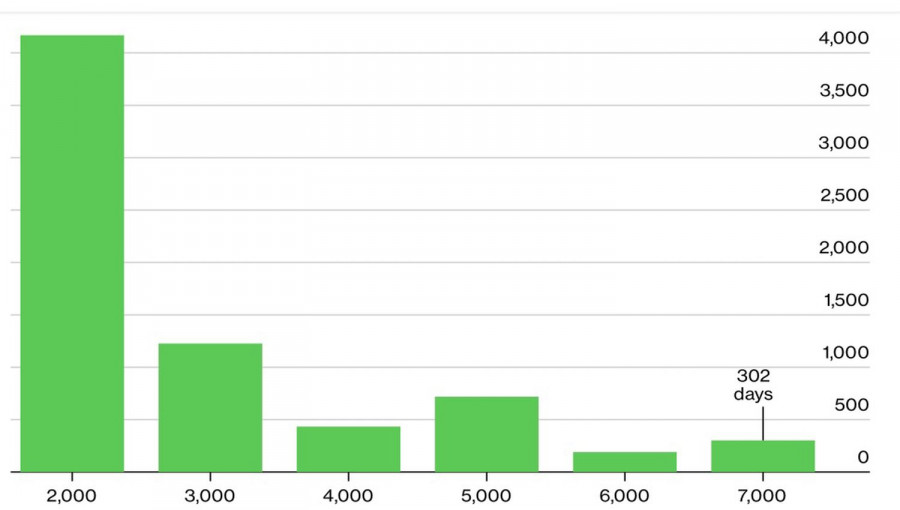

Fueled by investor optimism about earnings, the S&P 500 overcame the psychologically important 7,000 mark. It took the broad index 302 days to reach it. That level has become a kind of red line. Bulls argue it was reached on strong earnings momentum and that stocks will continue to rally. Bears point out that valuations are now even richer.

Timing of the S&P 500 reaching milestone levels

Markets are so focused on fourth-quarter earnings that they are tuning out not only geopolitics but also the Fed meeting. After three acts of monetary expansion, the central bank chose to pause the cycle, a vote opposed by Stephen Miran and Christopher Waller. Following that, Waller's odds of becoming the next Fed chair rose.

Donald Trump wants a "dove" at the helm of the central bank. However, the FOMC is not a one?man show, and continued support for Jerome Powell from other governors suggests cutting borrowing costs to 1% will not happen without a fight.

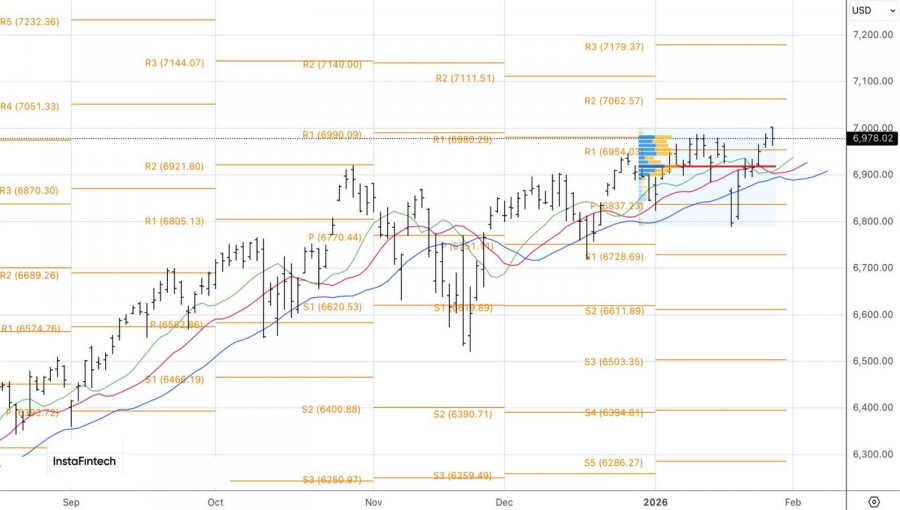

Technically, on the daily chart, the S&P 500 has pulled back after hitting a new record high. Sentiment remains bullish, so it makes sense to buy dips. They offer an opportunity to add to previously established long positions. Target levels are 7,060 and 7,140.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |